Budgets Are Typically Recorded for Which of the Following

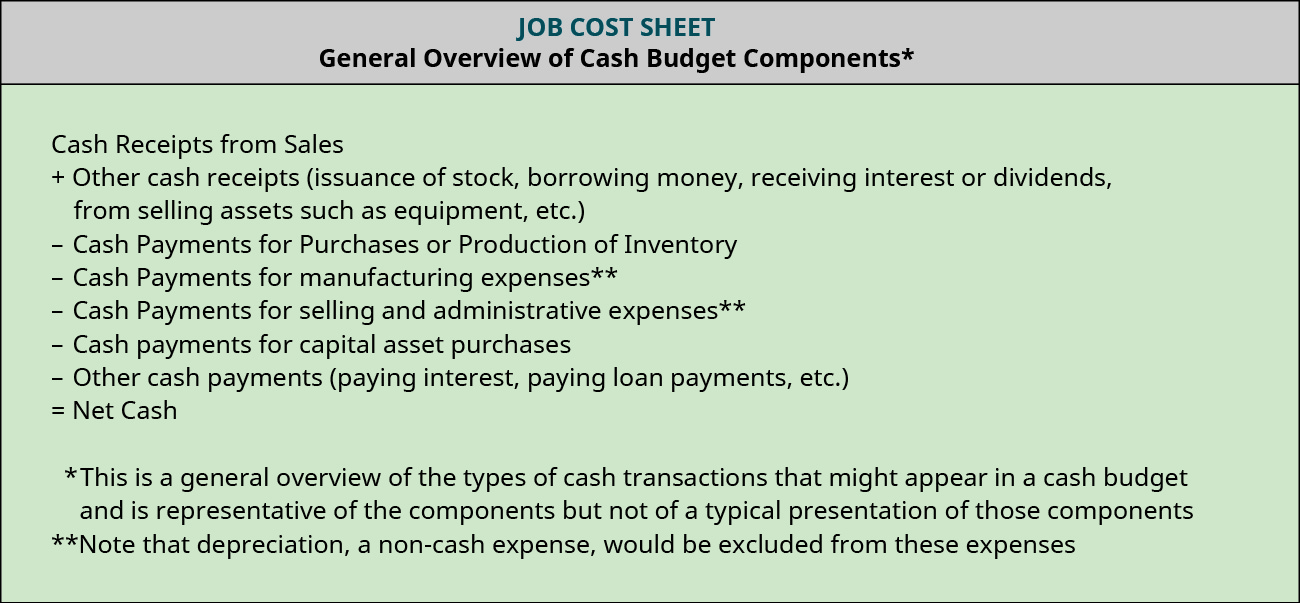

Cash payments for mfg overhead. The manufacturing expenses are further divided into Fixed semi-variable and variable costs.

Prepare Financial Budgets Principles Of Accounting Volume 2 Managerial Accounting

If all the expenses are to be met the restaurant should not.

. D All of the above are good reasons to have an emergency fund. Usually the budget is prepared department wise for efficient control over the costs. Which of the following types of budgets would be most likely to include a line item purchase of supplies Object Classification.

Record the stock dividend assuming a large 100 stock dividend. Who are the experts. B Debt Service Funds.

Operating budget of the business involves costs related to the operational activities. Budgets are typically recorded for which of the following. Record the transaction assuming a 2-for-1 stock split.

Prev 8 of 25 Next. The income flow includes the sales of the business. Cash payments for dividends.

The process of preparing a budget should be highly regimented and follow a set schedule so that the completed budget is ready for use by the beginning of the next fiscal year. From selling and admin budget. The costs include production cost overhead cost manufacturing cost labor cost administrative cost working capital etc.

Personnel Budget is one of the crucial types of the budget which covers the manpower budget for the specific period. Budgets are not typically recorded for capital projects debt service and permanent funds. In FASBs Statement of Financial Accounting Concepts No.

Food costs sales labour overhead profit 247 500 78 750 57 750 15 000. View Assignment 6docx from ACCT 372 at CUNY Queens College. A Capital Projects Funds.

B An emergency fund keeps you from borrowing money from friends and family. Which of the following types. Current operating revenues and expenditures.

We can make Operating budgets considering all the above factors. Cash payments for selling and admin. In California State government the.

Appropriation budgets are typically concerned with c. If a government records the budget and actual revenues exceed budgeted revenues what would be the impact on the. From direct labor budget.

We review their content and use your feedback to keep the quality high. C Debt Service Funds. C An emergency fund removes the worry about expenses not in the budget.

Which of the following funds typically do not record budgets. Capital expenditures budget b. Which of the following items are accounted for as revenue in a capital projects fund.

Budgets are typically recorded for which of the following. C Special Revenue Funds. Food costs sales labour overhead profit In the example being developed food costs are.

Which of the following funds typically do not record budgets. -typically prepare and record budgets-use the modified accrual basis of accounting. Many organizations prepare budgets that they use as a method of comparison when evaluating their actual results over the next year.

4 the FASB identifies the information needs of the users of nonbusiness financial statements. The master budgetwhich culminates in a cash budget a budgeted income statement and a budgeted balance sheet formally lays out the financial aspects of managements plans for the future and assists in monitoring actual expenditures relative to those plans. Multiple Choice Ο Enterprise Funds Ο Special Revenue Funds.

A An emergency fund prepares you for unexpected expenses. D None of the above. Budgeted income statement.

BUDGET BILL and BUDGET ACT. Cash payments for Income Taxes. A plan of financial operation embodying an estimate of proposed expenditures for a given period and the proposed means of financing them.

Budgets are used for two distinct purposes planning and control. Multiple Choice O Enterprise Funds. DGeneral Funds and special revenue funds.

Used without any modifier the term usually indicates a financial plan for a single fiscal year. -All funds typically prepare budgets-General fund and special revenue only. Ο Capital Project Funds.

Appropriation budgets are typically concerned with. From mfg overhead budget. CGeneral Funds and permanent funds.

B Special Revenue Funds. D None of the above. Current operating revenues and expenditures 2.

Which of the following funds typically record budgets AGeneral Funds special revenue funds capital projects debt service and permanent. Labor hours workers grade costs etc. And Capital Project Funds.

Which of the following budgets will typically have the longest budget period. Experts are tested by Chegg as specialists in their subject area. Budgets are typically recorded for the general fund and special revenue funds.

From budgeted income stmt. A Capital Projects Funds.

![]()

Capex And Opex Scaled Agile Framework

Medical Experiments The Holocaust Explained Designed For Schools

Capex And Opex Scaled Agile Framework

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-02-21e195b2934c40518828dc904cbdb86f.jpg)

How Are Prepaid Expenses Recorded On The Income Statement

Mood Journal 101 How To Get Started On Controlling Your Emotions

Capex And Opex Scaled Agile Framework

Pin On Lead Generation Charlotte

13 Ways To Reduce Cash Burn Rate And Extend Your Cash Runway

Average U S Consumer Debt Reaches New Record In 2020 Experian

Design Build Construction Defined Horst Construction

/dotdash_Final_How_Are_Prepaid_Expenses_Recorded_on_the_Income_Statement_Oct_2020-01-5994210f98a84b468a9a113c94643d50.jpg)

How Are Prepaid Expenses Recorded On The Income Statement

What Is An Operating Budget Overview Components Example

Au 319 Consideration Of Internal Control In A Financial Statement Audit Pcaob

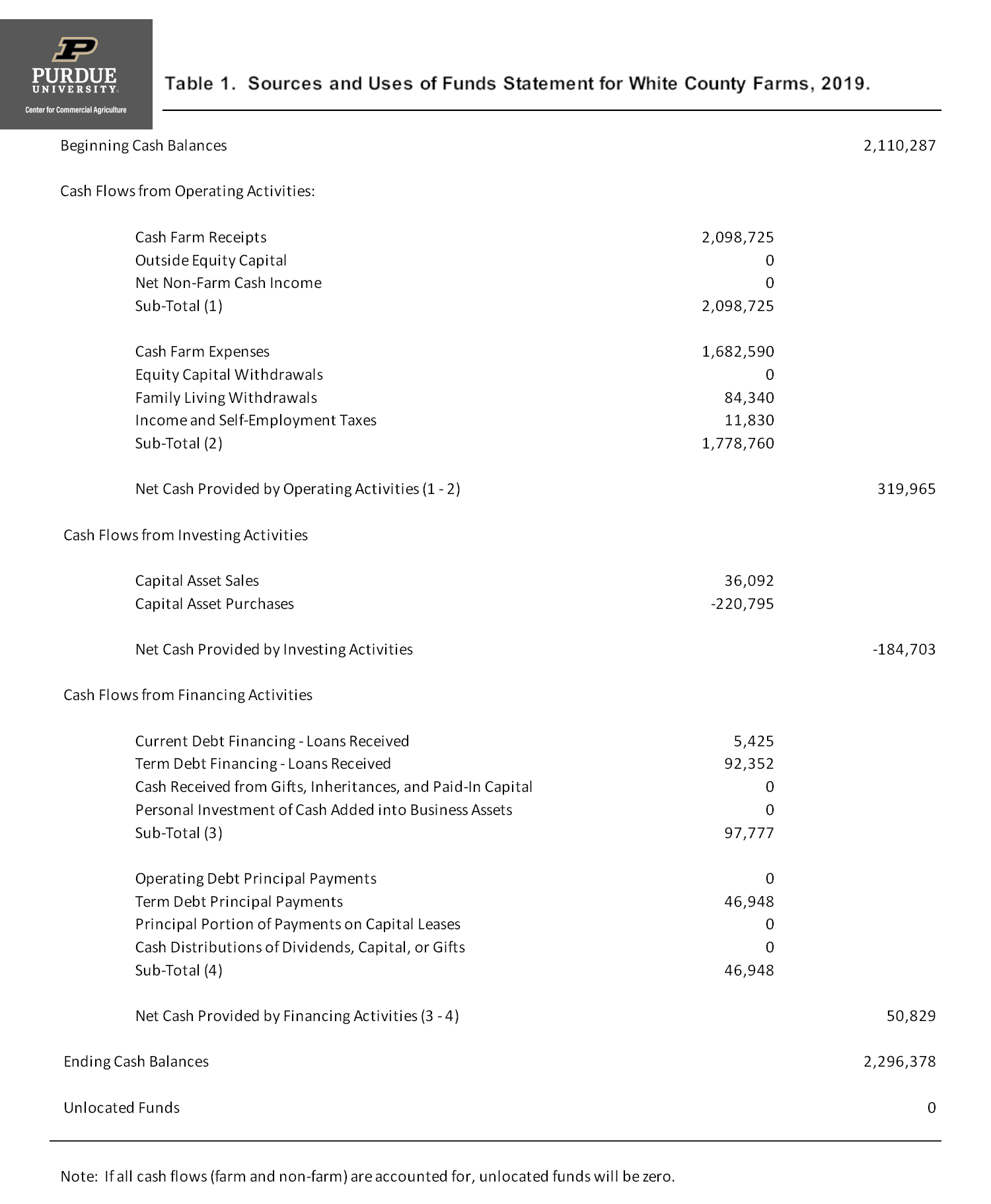

Sources And Uses Of Funds Statement Center For Commercial Agriculture

7 Actionable Tips For Grocery Shopping On A Budget Budgeting Finance Blog Save Money On Groceries

What Are State Balanced Budget Requirements And How Do They Work Tax Policy Center

Policy Basics The Abcs Of State Budgets Center On Budget And Policy Priorities

Comments

Post a Comment